In their official website (in a pdf fees document), the equation they mentioned does not match reality (depending on my practice with their demo trading account), nor logic.

My equation is: spread fee = (ask-bid) * number of units

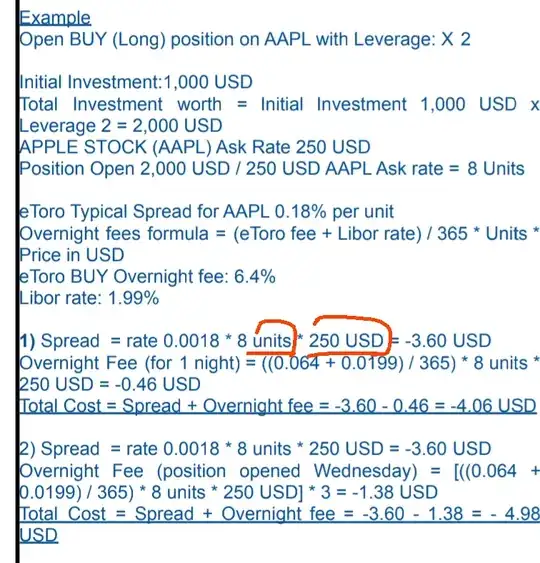

in their pdf file : spread fee = (ask-bid) * number of units * the share price

so If I want to buy one Amazon share (which was 4000 $ ; ask: 4007, bid: 4000) I assume I would pay 7 * 1 = 7 $ not 7 * 1 * 4000 = 28000 $

Is there an unintended mistake in their attached commission file?