This article: The Run-Up Before Ex-Dividend Date about the may be of use for you. I am not advocating or confirming the conclusions but the logic is relevant:

- Price anomaly: the price of a dividend-paying stock tends to drift up before the ex-dividend date.

- At the aggregate level, this upward drift takes place throughout the entire period from declaration date to ex-dividend date.

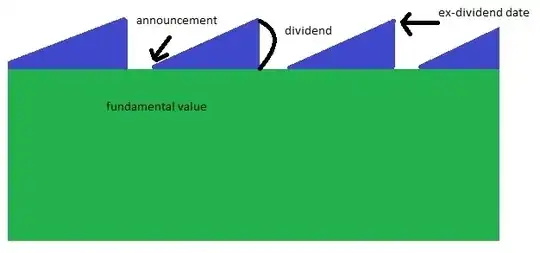

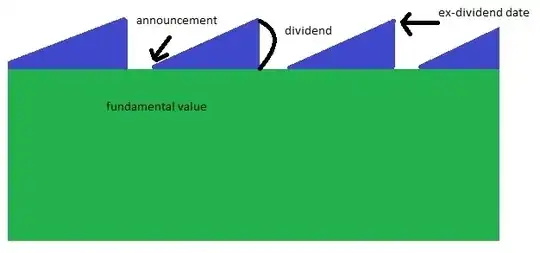

In other words, in lieu of other news and market sentiment, once the dividend is announced, the stock price is expected to increase during the period starting from the announcement to the ex-dividend date. The increase is expected to be the amount of the dividend. Once the ex-dividend date is past, the stock returns to it's fundamental value. Here's another article describing this at a higher level:

When a company pays a large dividend, the market may account for that dividend in the days preceding the ex-div date by a rise in the price of the stock. This is because buyers are willing to pay a premium to receive the dividend. However, on the ex-div date, the exchange automatically reduces the price of the stock by the amount of the dividend.

Another way to look at this is pretty intuitive, I think: if I am holding shares of a stock and I am due to receive a dividend payout tomorrow, it would be quite foolish for me to sell today if I am not compensated properly. The farther out in time that I receiving that payment, the less valuable it is at the current moment (NPV). Here's a visualization of the effect:

If we believe this (i.e. we believe in basic economics principles), if we hold a stock through the period before declaration through the ex-dividend date, the issuance of the dividend should have minimal impact on the value of the stock. In other words, we end up where we started plus the dividend.

Obviously, this is too simple because the fact that a company issues dividends at all has implications for it's fundamental value and if and when the dividend changes, that too could have major impact on the price. But again, to focus on the impact of the dividend declaration and payment alone, we want to imagine all of this is constant even though we know it never is in reality.

What as an investor can you do? If you believe the market is efficient, whenever you buy or sell the stock, you are getting a fair price. Let's assume you do or, like me, you think it's mostly true. I'll also assume the US. YMMV for other countries.

If you receive the dividend, you either pay the long-term capital gains tax rate (good) or income tax rate (bad). This mainly depends on how much income you have. If you are doing really well, you'll get hit with the income tax rate so you probably want to avoid this.

If you sell, you either pay long-term capital gains rate (good) or short-term capital gains rate (bad). It all depends on how long you have held it. To minimize the impact of dividends you could buy after the ex-dividend date and sell before or after the declaration. Aside from transaction fees, this might expose you to the short-term rate. Now if you've held this stock for a long time, it in theory doesn't matter when you sell but if you want to receive a premium for the dividend without income tax exposure, you can sell right before the ex-dividend date.

So this brings us to the heart of your question. Consider the assertion in this article:

This causes the price of a stock to increase in the days leading up to the ex-dividend date. In general, the increase is about equal to the amount of the dividend, but the actual price change is based on market activity and not determined by any governing entity.

On the ex-dividend date, investors may drive down the stock price by the amount of the dividend to account for the fact that new investors are not eligible to receive dividends and are therefore unwilling to pay a premium.

I've emphasized the key phrase here: "about equal" which gets at the core question you are asking. I did a little hunting and came across this paper:

Results show that out of the variables only earning per share and dividend payout ratio have a significant positive relationship while return on equity has negative significant relationship with the dependent variable. On the other hand all other variables, i.e. dividend per share, retention ratio and profit after tax have an insignificant relationship with stock market price.

But this is really about how issuing dividends affects the fundamental price of the company:

One percent growth in dividend payout ratio will cause 0.5848% rise in stock market price and one percent decline in dividend payout ratio will cause 0.5848 % fall in stock market price.

That's not really the question you are asking but it's maybe interesting to help develop your strategy. This paper seems to be a little closer to what you are looking for:

The results of this empirical study indicate that the stock prices move upward significantly after dividend announcements. Abnormal return (AR) and cumulative abnormal return (CAR) from the market model are statistically significantly revealed. The results confirm dividend signalling theory as the dividend announcements have significant impact on share prices.

I'm not able to see easily that it shows a % factor like what you have in your question. Instead it focuses on abnormal returns (AR) and cumulative abnormal returns (CAR) which seems to be common in these kinds of papers. There may be a way to turn that into what you are looking for but I'm out of time for this answer.