What's Wrong With Being a Turkey?

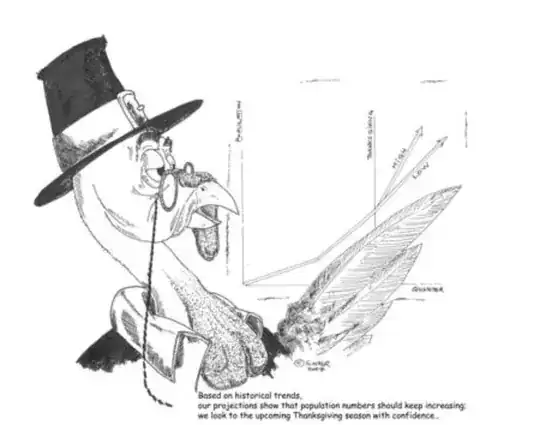

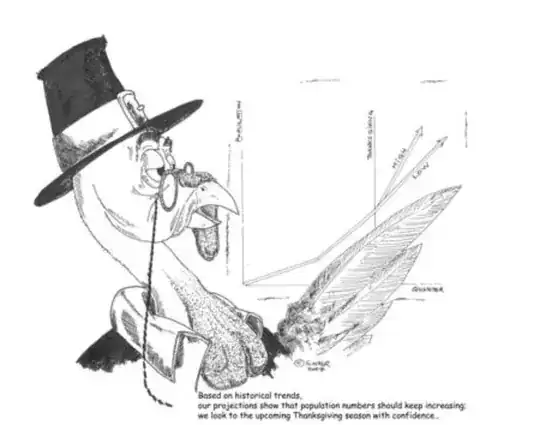

One of our dear friends comes to us to seek advice, since we seem to know a thing or two about money. Our friend just so happens to be a turkey - a particularly great turkey, thank you very much, so don't judge.

Our dear turkey friend is being told by all their friends that there is this incredibly friendly butcher they know, and believe it or not, as much as you might have heard rumors to the contrary, this butcher loves turkeys! Day after day, month after month, they visit this butcher and are given an incredible deal that is impossible to beat. In exchange for spending a little time with the butcher, they are given free food, shelter, warmth - all a turkey could possibly ask for!

Time after time, all the turkeys have had an absolutely wonderful time with the butcher, and have nothing but good things to say about them. All their turkey friends - including some very sophisticated, street smart, and well-educated turkeys - who have spent time with this butcher report only great experiences.

Now our turkey friend is feeling pretty bad about this whole thing. They are out, working their lives away for chicken-scratch like a sucker! Why shouldn't they get to wet their beaks, too? If this is a turkey-loving butcher, then why shouldn't they get the same great deal all their turkey friends are getting?

Now, from our perspective, the problem of our turkey friend is simple: they don't know about Thanksgiving.

You see, butchers do love turkeys. They love them, care for them, and protect them - right up until one fateful day when all of a sudden it won't be a good day to be a turkey. On that day no one will trade places with the turkeys for any price, and it will be too late to do anything about it - they will lose everything.

In our world, bad investments can work the same way. The mechanism doesn't really matter, be it ponzi scheme, money-laundering, confidence scam, embezzlement, organized crime, government corruption case, exotic derivatives trading, real estate tranches, A-rated securities (rated by once-admired pay-for-rating agencies), cryptocurrency-related scams (fake ICOs, mass stolen coins, evaporating alt coins, roach motel exchanges, questionable legal/tax treatment, market manipulation for cyclical pump and dump, etc.), or whatever the next sweetheart deal turns out to be. The result is that the world can look very bright right up until the day it doesn't anymore, and it only ever seems obvious in retrospect.

And the thing is, much like the turkey, we don't know when our version of Thanksgiving is scheduled.

Are you willing to make a special arrangement with the butcher, not knowing exactly on what day it will be a bad day to take that bet? Sure, of course you have something to gain, and those gains might be very precious if you could get them - but what would you do if you lost? How many weeks, months, or years of effort and sacrifice went into creating the savings you are willing to trust with the butcher? And do you know you'll only stand to lose what you invested and not more? Butchers tend to take more than turkeys thought they were "investing".

Remember the noble turkey, and consider the great care and effort put into taking care of animals being fattened up before the slaughter. This is the turkey problem, and the best way to win the game with butchers is not to be on the turkey side of the arrangement. Gobble gobble.

* this story is adapted from Nassim Taleb's telling of the turkey problem in The Black Swan, Antifragile, etc.

3 years at 150% every month and you are a millionaire by investing only 1 dollar !

– agemO Sep 05 '19 at 08:20You can take a sheet and show them how 100$ will evolve.

– agemO Sep 06 '19 at 07:06After 1 year: 129 746$

After 2 year: 16 834 112$

After 3 year: 2 184 164 409$ (2 billions !!!)

After 4 year: 283 387 333 428$ (283 billions, no ones is that rich)

If the casino can do that they don't need anyone to invest, period. Ask them when this started (you can even say that you prefer something safe that has been going for a long time, so that they will try to give you a very large answer).

– agemO Sep 06 '19 at 07:20