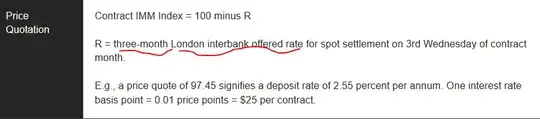

The CME webpage states that Eurodollar futures settle to 3 month LIBOR:

My question is regarding the underlying LIBOR term deposit rate mentioned in the contract spec. Suppose today is Tuesday, Feb 26, 2019 and 3 month LIBOR is 2.57%.

- Is it true that the 2.57% rate refers to a borrowing period starting Thursday, Feb 28, 2019 (settlement date T+2) through Tuesday, 5/28/2019, a period of 89 days?

Suppose now it is one day later: Wednesday, Feb 27, 2019, and 3 month LIBOR is unchanged at 2.57%.

- Is it true that the 2.57% rate refers to a borrowing period starting Friday, Mar 1, 2019 (settlement date T+2) through Wed, 6/1/2019, a period of 92 days?

Suppose finally that all economic considerations for interest rates remain unchanged between Feb 26 and Feb 27 (i.e. no changes in credit quality, supply/demand, etc.).

- Would you expect the 3 month rate to change (increase) due to the extra 3 days in the borrowing period? I.e. might 3 month LIBOR differ between Feb 26 and Feb 27 due only to the longer lending period? Or, do lenders not make this distinction when defining a "3 month" borrow rate?