I tried asking this in electronics as a question related to oscillators, but I wasn't able to get a satisfactory answer. I think the more math-y types here may shed some additional light on the phenomenon I am observing.

I am using two clocks (measured-clock and reference-clock) to measure the time of one relative to the other. I plot the accumulated difference between the clocks (in microseconds) vs. the total time elapsed on the reference-clock (in seconds). After collecting an hours' worth of data, I can perform a linear regression to determine the difference in frequency between the clocks.

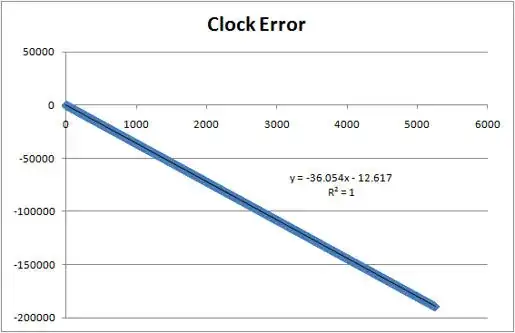

The linear regression has $r^2 = 0.9999$, so it's about as perfect as you can get. The slope of the line is, for example, $-36.3$. This implies that for every second of reference-clock time, the measured-clock falls 36.3 microseconds behind.

I then tune the measured-clock so that it has an extra 36.3 microseconds per second. I then re-run my analysis, expecting a very flat slope and poor $r^2$. Instead, I get another $r^2 = 0.9999$, with a slope of about $-1.2$. If I adjust for an additional 1.2 us/s (bringing the total to 37.5 us/s), I then get the satisfactory "flat slope and poor $r^2$".

It appears as if the first linear regression was wrong, despite the perfect $r^2$. Iteratively calculating linear regressions while $r^2$ is very high will arrive at the correct answer, so it seems as if there is some systemic error that I am unaware of. What am I doing wrong?

EDIT:

My initial clock frequency estimate is 14,318,180 Hz (the HPET timer). From iterative regressions, I can determine that the real clock frequency should be 14,318,712 Hz. This is an additional 532 ticks per second, which implies that the actual error is $-37.156$ us/s.

Here is the initial regression. The X axis is the elapsed time of the reference clock, in seconds. The Y axis is the difference between the elapsed time on the measured clock and the elapsed time on the reference clock, in microseconds (i.e. the error between the two clocks as a function of the elapsed time on the reference clock). The reference clock is precise, but not accurate, however I want to match any inaccuracy in the reference clock so that's okay.

Here is a plot of the residuals for that regression.

The initial regression suggests an error of $-36.054$ us/s. This is an additional 516 ticks per second, suggesting that my HPET is really $14,318,696$ Hz. As mentioned above, however, this value is not correct.