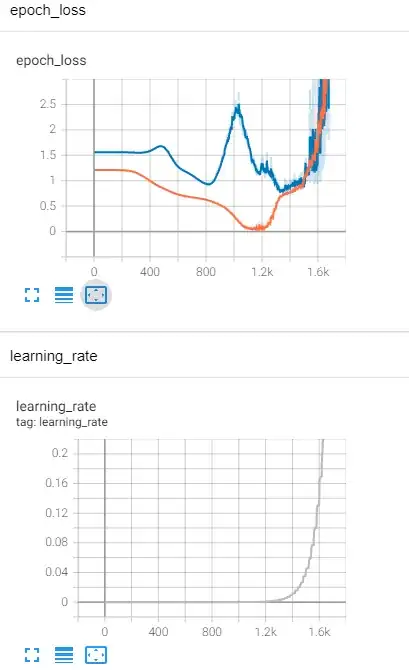

I am using stock prices and a whole bunch of indicators values to try to get a tensorflow model to predict to buy,sell, or hold. I think im going about this right but when i train the model, first i set a learning rate scheduler to increase the learning rate until the model converges and i use the training rate from the graph where the train loss and val loss first make their steeppest slope down for the next training run. so then the losses are smoothly going down and eventually the training loss will keep going down but the validation loss starts to move back up again. I dont know what that means, if its bad or good haha. Ive been at this all day.

Asked

Active

Viewed 40 times

0

-

It is not fully clear which curves are colored what in your plots. That said, "the training loss will keep going down but the validation loss starts to move back up again" can be a sign of [tag:overfitting], and is the motivation behind early stopping. – GeoMatt22 Mar 11 '21 at 19:48

-

Thanks for the reply. If I use early stopping based on validation loss, when I finally train my model without validation what should I base the stopping on? Would it still overfit – JRowan Mar 11 '21 at 21:15

-

in the bottom graph, the green line is validation loss and the red line is train loss. the green line is starting to go up – JRowan Mar 12 '21 at 01:47

-

Note that validation is not the same as test (e.g. see here). Also, you do not necessarily need (or want) to use all the data for the final model (e.g. see here). – GeoMatt22 Mar 12 '21 at 18:28