The Bitcoin ratio vs other currencies is not the same among exchanges. Is there currently a way to exploit this arbitrage and profit?

-

This is what I actually meant to ask: http://bitcoin.stackexchange.com/questions/569/how-much-room-for-arbitrage-is-there-currently-in-the-bitcoin-market I'll accept the answer to the current question because it sort of answers the letter of what I asked, if not the intent. – ripper234 Sep 04 '11 at 23:09

4 Answers

Yes. Simply hold accounts on multiple exchanges. In the account you should try to keep your holdings at 50% bitcoin and 50% other currency.

When there is an arbitrage opportunity you can execute "complimentary" transactions on both exchanges. On one you buy the difference, and the other you sell the difference. You can then equalize the accounts by transferring bitcoins between them, or withdrawing profits. Don't forget to account for transaction fees on each exchange.

If you are so skilled most exchanges have APIs that would allow you to script interfaces for doing this automatically. I recommend against accepting other people's scripts to do this since it gives the script access to your funds and it would be trivial for them to write the script to transfer your funds to them.

- 14,825

- 6

- 66

- 87

- 4,076

- 25

- 26

-

1

-

It is as efficient as is possible. Given that you should not trust anyone else's tools to do it. – Joshua Kolden Aug 30 '11 at 23:13

-

1It is also worth pointing out that the more "efficient" the market gets, and the easier it becomes to arbitrage, the less opportunities there will be for such a thing. You should be aware that in any arbitrage play, you can get "stuck" if one of the exchanges is not as liquid as you thought it was going to be. – lemonginger Aug 30 '11 at 23:19

-

5The only problem with this approach is that you eventually wind up jammed, with coins in the wrong place. Fortunately, if they're bitcoins, you can pretty easily move them. But if it's cash, it can take you quite some time to move it from one exchange to another. If one exchange is consistently higher than another, you are quite likely to get jammed a lot. – David Schwartz Aug 31 '11 at 00:02

-

This is what I actually meant to ask: http://bitcoin.stackexchange.com/questions/569/how-much-room-for-arbitrage-is-there-currently-in-the-bitcoin-market – ripper234 Sep 04 '11 at 23:08

-

1Its possible and most likely to happen with small and inactive exchanges. But the low volume traded there also limits the profit, as even a small pair of transactions will level the prices to near equality and no profit. – Jürgen Strobel Oct 20 '11 at 23:59

-

I'm not sure this is arbitrage as much as it is hedging. The do seem similar in this example though. – Jan 14 '18 at 18:11

CryptoStreet will allow exactly that. (disclaimer: I'm one of the owners). We will hold funds at the various exchanges and you hold funds with us. That'll allow you near instant trades across various exchanges and enjoy arbitrage

- 2,849

- 3

- 35

- 52

In order for arbitrage to succeed, you need to be able to execute nearly simultaneous buy and sell transactions across exchanges, not do it manually.

Why? Because the slower arbs will always get beat by the faster arbs, and slower arbs are left holding stuff they now need to buy or dump. This was the case when there were multiple automated exchanges for NASDAQ stocks - they eventually consolidated, but for a while there was quite a competition to build the fastest arb bot, and a difference of a few ms could make all the difference in successfully executing arb flips.

- 51

- 1

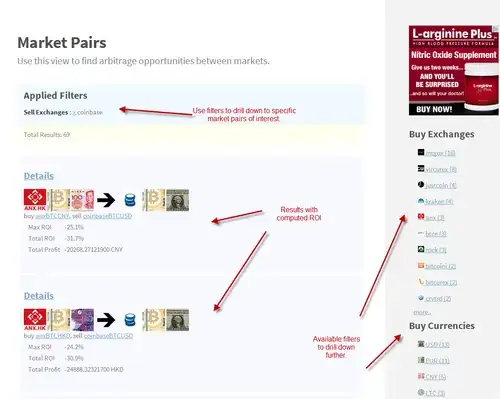

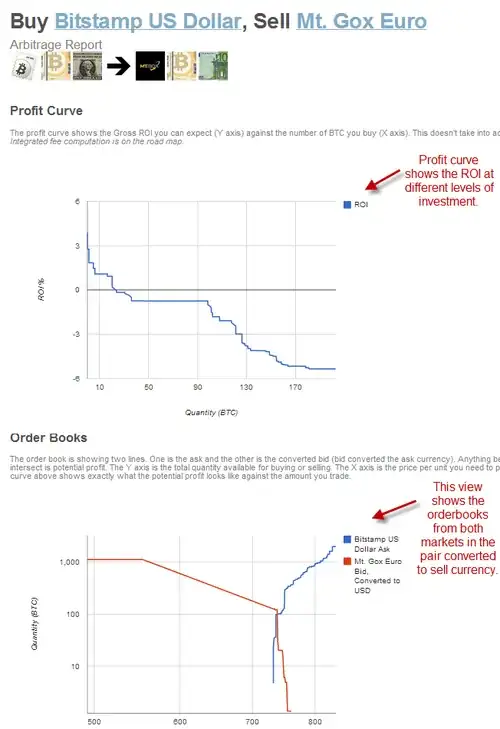

Yes, at Bitdango you can use the Market Pairs search to find market pairs you want to take advantage of arbitrage on. Open the detail report to see how much profit you make at different levels of investment. https://bitdango.com/marketpairs

First search:

Then view details:

An API is coming soon, so that will give you an interface to develop your on software bots against. This will take all the heavy lifting out of the monitoring and analysis aspects of arbitrage.

- 129

- 5