I have seen that side chains/2nd layer solutions that utilize smart contracts on the bitcoin network are feasible and in use. If the 'programmability' feature of smart contracts is available on the bitcoin network, why is all of DeFi currently on the ethereum network instead? Does the former have inherently worse features for the usage of smart contracts? If so, what are they?

2 Answers

If the 'programmability' feature of smart contracts is available on the bitcoin network, why is all of DeFi currently on the ethereum network instead?

- Better marketing

- More funding

- Investors

- Users and Exchanges that are already familiar with creating tokens on Ethereum.

- Although projects exist, few users and devs are not interested in using them. Bitcoiners don't want to use these projects, altcoiners already have a community and things they can use so such projects end up with less volume.

- There is a perception among people in this space that Bitcoin can only be used as digital gold.

- Less exchanges support Liquid, Rootstock and LN

I have tried to explain 'DeFi' in https://bitcoin.stackexchange.com/a/108303/

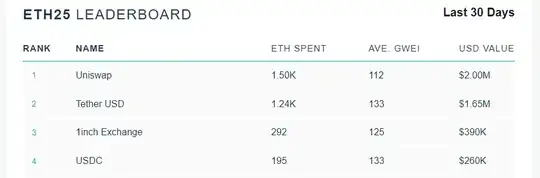

Most of the gas used on Ethereum is either by DEX or stablecoins. Both things exist on Bitcoin sidechains.

People can have different opinions about difference in volume and usage. Even the centralized exchanges like Coinbase, Bitstamp, Bitfinex, Binance, Okex, FTX, Deribit, Bitmex etc. have different volume even though its not related to technology used by exchanges or things supported.

If you ignore scalability and privacy, it is easier for developers to write smart contracts onchain and within Ethereum's VM. Not only can you use a Javascript like language (Solidity) but your contract can update automatically based on changes in state. Bitcoin deliberately restricts state changes to unlocking UTXOs and immediately locking them again.

You can replicate many smart contracts on Bitcoin but because Bitcoin is focused on long term scalability and privacy as much as possible is pushed offchain (you have to deal with payment channel capacity and routing etc) and requires cryptographic tricks like adaptor signatures before a transaction is broadcast onchain. This makes life harder for a developer and creates more work but at least in my view there is no alternative. You could ignore privacy but long term scalability is critical. What's the point of making something easy to use if any wide scale usage pushes transaction fees up pricing out that and other use cases? There is very little progress and activity on 2nd layer solutions for Ethereum I think partly because of the complexity of new tokens introduced and partly because then you have to struggle with the same challenges of doing smart contracts offchain as Bitcoin.

- 15,313

- 3

- 17

- 53

-

You can use same language: solidity on Rootstock or even other chains like BSC, Solana etc.. Question is why someone prefers Ethereum. – Aug 27 '21 at 09:01

-

Question is Bitcoin vs Ethereum. It doesn't ask for a comparison between Ethereum and Rootstock or Ethereum and Solana. I don't know anything about Solana, presumably it uses accounts rather than UTXOs and an EVM equivalent too? I'm not particularly interested in Ethereum let alone Ethereum clones ;) – Michael Folkson Aug 27 '21 at 09:40

-

There is a lot more tooling and ecosystem around Ethereum than Rootstock. If you don't care about scalability and privacy and you're doing an academic project I'd probably recommend Ethereum over Rootstock. – Michael Folkson Aug 27 '21 at 09:43

-

Question clearly mentioned 2nd layer/sidechain – Aug 27 '21 at 09:48

-

OK maybe I should add that sidechains have different trust models and less tooling, ecosystems built around them (other than perhaps Liquid). At least in theory access to the Ethereum chain is open in a way that multisig sidechain pegs aren't. The plan for DLCs is to use payment channels, Lightning rather than sidechains. – Michael Folkson Aug 27 '21 at 09:52

-

DLC can used with any chains that support ECDSA and Schnorr signatures. Bitcoin-s devs had answered this once in slack. – Aug 27 '21 at 10:03

-

I don't know why the above is relevant. I thought we were talking about 2nd layer/sidechains not other chains. – Michael Folkson Aug 27 '21 at 10:18

-

@MichaelFolkson could you elaborate on how/why the bitcoin network/side chains/2nd layers are more scalable? Does this have to with size of the blockchain? Or something else? – Runeaway3 Aug 27 '21 at 14:10

-

@Runeaway3: It is just the concept of doing as much stuff offchain as possible. For example Lightning only touches the chain on channel opens and channel closes. In the meantime you could have hundreds, thousands of transactions that the chain never sees. Similarly with sidechains. If you assume the premise that blockchains are a limited resource and can't support the global economy using them for every transaction, every smart contract etc you want to use them as sparingly as possible. – Michael Folkson Aug 27 '21 at 15:41

-

@MichaelFolkson and the bitcoin network is better at this because all smart contracts on ethereum touch the blockchain each time? – Runeaway3 Aug 27 '21 at 16:01

-

Right. Not only the smart contracts but the state transitions of those smart contracts. You lose the benefits of the Ethereum VM (e.g. the rich statefulness) if you are operating outside of it most of the time. – Michael Folkson Aug 27 '21 at 16:07